In our last post titled, “Profit and Market Cap – The inseparable twins”, we discussed how profits earned and value created by businesses are directly correlated.

As you would expect, businesses that can produce a high level of profits for a long time to trade at a premium to the broader stock indices. Hence, the biggest challenge for investors is to identify a fair value for these businesses as they are unlikely to be available at cheaper valuations.

“A great business at a fair price is superior to a fair business at a great price.” – Charlie Munger

We would like to share with you the process that we follow at East Lane Capital to determine fair value for such businesses. The Consumer Sector, in particular, has always traded at significant premiums to the broader market. Hence, we discuss our framework for arriving at a fair value for consumer companies.

Why has the consumer sector done so well?

Consumer sector offers structural growth and high return on capital and hence an attractive ground to hunt for long-term compounding stories.

With increasing per Capital income structural growth story has been playing out

Last two decades have seen a significant increase in the breadth and depth of the consumer sector in India.

Household Income crossing US$3500 a real kicker for discretionary consumption

Discretionary consumption hits an S curve as the household incomes cross US$3500. As experienced in other markets the countries in the household income band of US$3500-7000 have seen a sharp surge in discretionary consumption.

The number of households in this bracket in India is still small. This is reflected in the restricted number of higher-end consumers. With sustained GDP growth the number of households in US$3500 income bracket will increase driving consumption growth. Rising consumer credit will also help drive consumption. The consumer markets will evolve as household incomes rise.

New business models are emerging

Traditional retail will remain dominant in the foreseeable future, but modern retail and E-commerce will see substantial growth over the next decade.

Last decade has seen a sharp re-rating for the sector

The re-rating over the last ten years was driven by:

1) earnings growth due to low raw material costs and GST benefits boosting margins.

2) falling cost of capital boosting valuations for growth stocks.

What would happen if there is a shift in the growth drivers?

While the long-term growth story driven by rising incomes is intact, the factors which resulted in sharp re-rating in the recent past are reversing. Can this result in correction in valuations? What will be a fair price for these stocks? we discuss our broad framework below.

How do we determine Fair Value?

We highlight our framework for FMCG, modern retail, and e-commerce companies taking examples of three stocks in this sector. This is a broad framework, each individual stock will have its nuances as regards its strategy, execution, market focus, etc.

Example 1: Hindustan Unilever (Market Cap USD65.8bn)

Best-managed fast-moving consumer company. Revenues have grown at 9% and profit CAGR of 9% and 15% over the last decade. FMCG revenues have been growing at GDP plus but the falling raw material costs and benefits of the GST regime drove margins. Higher inflation is a dampener for margins and cost of capital, and the probability of valuations correcting is high. Could the PE multiple for the stock de-rate from 50x to 35x forward earnings either through stock price correction or time correction or a bit of both?

Example 2: Avenue Super Mart (Market Cap USD34.5bn)

Supermarket chain with best-in-class execution. Per-store economics suggests a derived value per store of Rs2059m i.e., Current enterprise value is discounting 1276 stores as against 250stores at present. The company has a long-term potential to open 5000 stores.

The company opens 50 stores pa at present. How many stores should we pay for to compound our investment at 15% over the next 3-5 years?

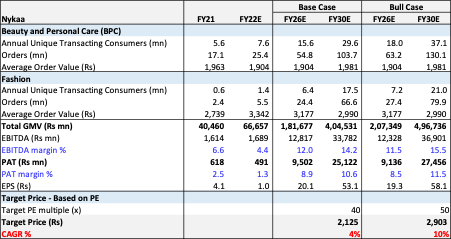

Nykaa (Market Cap USD10.7bn)

E-commerce platform in beauty and fashion products. The company has built a successful platform consuming little capital for the beauty business. Company earns a double-digit margin in this business. The key questions in our mind are:

1) How many customers can it continue to get on its platform, or the income cohorts as discussed above become a constraint for sustaining high growth.

2) While the network effects can see good operating leverage, can the margins compete away?

Fashion is a larger market opportunity but more competitive. Can this business remain a drag on profits for a very long time? What are other areas the company can pivot into and increase growth opportunities?

A lot of these answers are not known but will only get clear as data emerges. We try to build scenarios for the next 10 years and assume fair exit multiple assuming that the period for growth will last beyond 2030.

Investing is never a simple mathematical equation, however, the frameworks discussed above help us build a thesis on the stocks. We keep finetuning the thesis as our understanding of the businesses improves and new data emerges.

Identifying great business is only half of the job. The ability to buy them at fair value is as important, if not more. At East Lane Capital, we spend each day fine-tuning our understanding of the businesses and in equal measure determining their fair value. We strongly believe that our process will lead to significantly superior results for our investors.