“The market determines how big the company can get, and the people determine how big the company will get.” Pat Grady

The Indian stock market delivered a subdued performance in 2024 returning just 6% in USD terms. However, the cyclical sectors and small cap index continued to report a strong performance. After a strong bull run over the last 3 years, the big question is everyone’s mind is – what to expect in 2025 and beyond?

In this note, we analyze market cycles over the past 20 years and review East Lane Capital’s (ELC) performance since our inception four years ago. Using a framework of three key factors—domestic macro and policy, global drivers, and earning cycles with valuations—we attempt to understand past market dynamics and their implications.

At East Lane Capital, while we emphasize fundamentals-driven stock picking, we recognize the importance of being attuned to market cycles. Studying these cycles provides a framework for identifying potential turning points and fosters adaptability—reminding us that today’s cycle losers can become tomorrow’s winners.

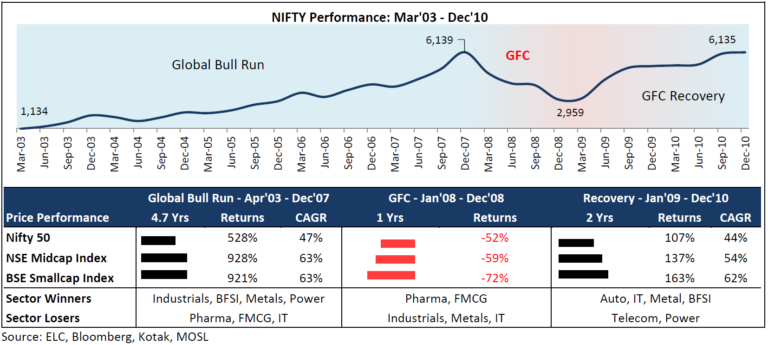

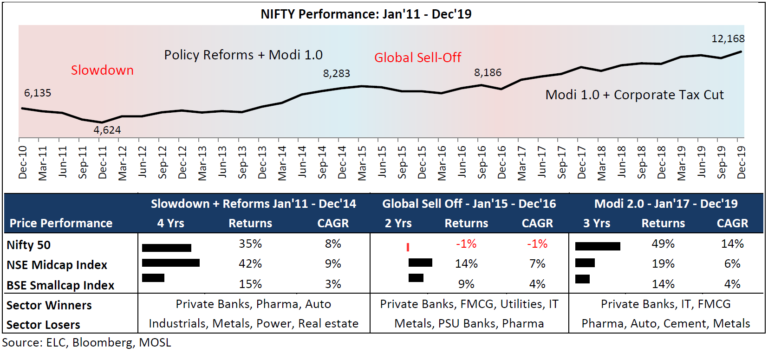

There have been three big cycles in the last 20 years:

However, when you evaluate the entire cycle from 2003 to 2024, One of the most interesting facts which emerged from analysis is that over the last 20 years, Nifty returns mirror the earnings growth. Nifty delivered CAGR returns of 12.8% and the CAGR earnings growth during the same period was 12.0%. While the cycles will persist, over long-term fundamentals do catch up. Let us evaluate each of the phases in greater detail.

Mega bull run 2003-2007 – NIFTY CAGR of 47%

This cycle started post the dotcom bust, Nifty delivered 47% compounding but as in every bull cycle small and mid-caps indices delivered a stronger performance with a CAGR of 63%. Global Financial crisis (GFC) was a trigger for a sharp 52% correction in NIFTY, but the small caps index corrected by 72%. The market did recover post GFC with sharp infusion of liquidity in the economy but stagnated for a long period since 2011. Cyclical sectors like industrials, metals and BFSI reported a strong performance. Defensives like FMCG underperformed.

Cycle began with improving macro factors, positive policy action especially for infrastructure and cleaning up of bank balance sheets in early 2000. However, as the cycle progressed, inflation picked up and interest rates started rising in 2007.

Global environment was favourable, China became a strong driver for global growth and commodities.

The valuations in 2003 were very attractive at 7x. Earnings compounded by 25% over the cycle. Market peaked with valuations 23x in FY08. The trigger for market collapse was global financial crisis which led to 52% collapse in the markets. Post GFC there was massive infusion of liquidity both globally and in India which resulted in sharp revival in the markets. However, markets did not breach the pre-GFC peak.

Sideway markets 2011 – 2019 – Compounded annual returns of 8% – A painful period of low returns

Post the bull run, the markets stagnated for a long period delivering a CAGR of only 8% between 2011 to 2019. The small cap index significantly underperformed during this period with CAGR of 4%. Long duration growth and defensive stocks performed well during this period.

Post the investment boom private sector leverage considerably increased, policy environment became very unstable, both inflation and fiscal deficit moved up. Modi government took charge in 2014, fiscal consolidation and reforms accelerated. Banks balance sheet clean-up started. However, demonetization was a major discontinuity for the economy. The global environment was volatile with a huge liquidity influx and very low interest rates.

Earning CAGR was merely 5.5%, starting valuations were 16x and end of the cycle valuations were 23x

Covid correction & Recovery

COVID resulted in a sharp 29% correction in the market in 4QFY20. Post covid bull run starting in September 2020 delivered 19% compounding until December 2024. Small and mid-cap indices have delivered a CAGR of over 30% during this period. Auto, metals, power, cement, IT and PSU’s have been key winners during this cycle.

Global environment has been mixed with US outperforming rest of the world and China struggling.

What should expect in 2025 and beyond?

After a strong run in the markets, the current scenario is a mixed bag. The positives are focus on fiscal consolidation and capital expenditure by the government, low corporate leverage, well capitalized banking system and private capex at decade low. Earnings are expected to grow by 15% over the next two years. On the negative there is an increasing trend of handouts by the state governments, a volatile global environment, slowdown in consumption resulting in earnings downgrades over last two quarters. Market valuations are also trading at higher end of the range. Barring any global adverse event, long-term potential continues to look favourable.

Earnings are expected to grow at 15% over the next two years but there have been downgrades over the last 2 quarters.

Taking stock of four years at East Lane Capital

East Lane Capital has completed four years on 19th December 2024. East Lane was set-up with the objective to do research based long-term stock picking, and we curate a portfolio of 20-25 stocks for our investors basis our research framework. We only have one strategy, but we do not invest based on a model portfolio. Hence the client portfolio do differ in holdings, stock prices may not have same risk/reward at different times. As a result, client portfolio performance will differ from the aggregate reported performance. I am happy to share with you that the overall portfolio reported an 18.6% CAGR over last four years against an index return of 14.7%.

Performance of a stock price is an interplay of fundamentals i.e. earnings and a valuation multiple. Valuation multiple is nothing but a proxy to discounted future cashflows. Sometimes the market discounts far out in future and sometime the focus turns to near-term fundamentals leading to sharp corrections. Over the long-term earnings drive the stock performance, in the short-term sentiments can takeover fundamentals. We will continue to focus on building a portfolio of stocks with long-term fundamentals in mind.

Wishing you and your loved ones a very happy & prosperous 2025.