2023 has been one of those rare years where all asset classes including equity, debt, gold and real estate have delivered acceptable to exceptional returns!

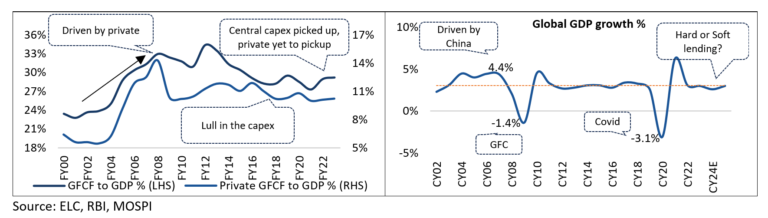

Belying fears of recession, the year gone by saw strong performance from global equities except China. The developed markets, US and Europe, reported strong gains and emerging markets like India and Brazil reported good performance too. In the coming year, global equities will have to navigate many variables viz. elections, inflation, interest rates etc. The debate on hard or soft landing is likely to keep the global markets volatile.

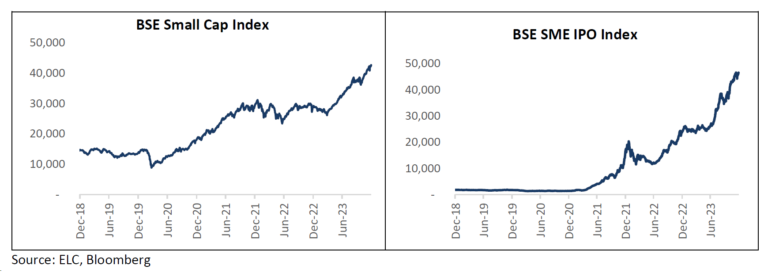

Indian markets reported a decent performance with Nifty index up 19% in USD terms. From a business cycle perspective India looks to be in a recovery phase reflected in a strong 55% returns for the small cap index. The key question in 2024 will be how enduring is the recovery (navigating the domestic elections and global growth) and how much is already in the price.

In this note, we closely look at the business cycle in India and look at a stock example to see what the prices are discounting. The macro analysis helps us set a framework to think about the markets, but our focus remains on bottom-up stock picking. We are agnostic to market capitalisation and focus on investing in a good business, with a good management and at a reasonable price.

Developed markets and Indian small cap index reported strong performance in CY23

Recovery phase => cyclical sectors outperforming in India

Analysing the cycle – fiscal prudence positive for the cycle

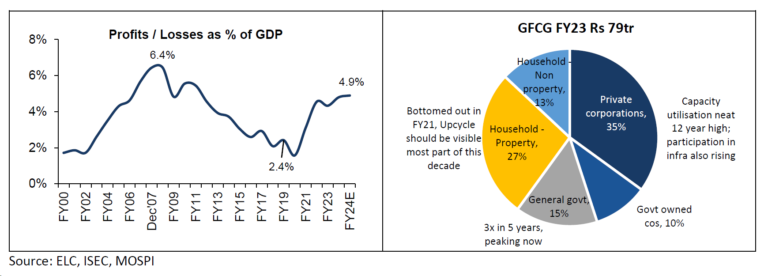

The current government has been fiscally prudent with focus on capital expenditure to kick start the cycle. In an election year, there is always a fear of fiscal prudence being put to a backburner and the government turning populist to win elections. However, the recent victory by the ruling party in the state elections gives hope that the path of fiscal prudence will continue.

Macro picture is strong – Governments focus on capex is the key positive

The capex cycle at an early recovery phase

The last capex cycle in India between 2003 to 2012 was driven by private sector participation and strong global growth. The current upturn in cycle is largely driven by increase in central government capex. Private sector participation yet to meaningfully pick-up. A global recession or major shift in government policy (handouts or change in government) will be risks to continued recovery in the cycle.

Domestic capex aided by strong global growth was driver of last cycle

Despite strong balance sheet; private sector capex yet to pick-up

If Private sector capex picks up, earnings growth will get stronger.

Anticipating a recovery; small cap index has reported strong performance.

Domestic flows remain strong, and the number of first-time retail participants has increased.

Analysing what’s in the price: Suzlon – A case study:

Let’s look at an example of Suzlon (Market Cap Rs 520bn/US$ 6.2bn) to see what has been going on in one section of the mid/small cap market.

Suzlon is the largest wind turbine manufacturer in India with a current market share of 32% of India’s installed base. From peak in last cycle, the company faced near death experience due to bad capital allocation and reversal in the cycle.

The outlook for wind sector has improved with the right government policies. India has a target to reach 100GW of wind capacity by 2030 from present 45GW implying incremental 8GW required per annum.

Restructuring of the debt by banks and equity infusion by Investors has seen a 7x increase in stock price from the bottom in 2021. Peak to trough, the stock price for Suzlon is still down 90%.

What does the current stock price imply?

The company earns EBITDA per MW of Rs 7mn and makes about Rs7bn of EBITDA on Operation & maintenance (O&M) per annum. The current enterprise value (EV) of the company indicates that Suzlon needs to deliver 2.7GW of wind capacity assuming a lofty 20x EV/EBITDA multiple. The 20x EV/EBITDA implies further acceleration from 2.7GW of execution per annum. The turnaround is real, but the market seems to have run ahead of itself.

Are the markets euphoric?

Suzlon is just an example of one of the many stocks, particularly in mid and small cap space, that have benefitted from the capital spends of the government and the improving investor sentiment. As stock prices started to rise, a wave of new investors have got attracted to the price momentum, further fueling the rally in mid and small caps. As a result, the small cap index has grown by a whopping 55% in 2023.

Markets discount future profits. In a bullish phase, markets tend to discount the far ahead future and becomes lenient towards the execution assumptions. Whereas in a bearish phase the market focuses on the near term and is very stringent about the execution assumptions. The reality is usually somewhere in the middle.

In the long-term profits and stock returns tend to converge. Whether it is a small cap company or a large cap, long-term profit growth depends on the nature of industry and management’s execution capabilities. With a small cap company, you take additional liquidity risk with potential for higher growth given the small base. However, execution remains the key. The reality is that only a few small caps can turn into large caps over the long-term.

Only 10% of companies compounded market cap at 15% and only 4% at 25% from FY05-FY23

We at East Lane Capital are market Cap agnostic. Each stock is looked at on its own merit. We also keep in mind the additional liquidity risk embedded in the smaller companies. We are very focused on assessing the quality of management, not only in terms of their integrity but their ability to execute and deliver superior results for a long period of time. We look for businesses with growth potential at a reasonable price. We initiated positions in Technocraft Industries and Krsnaa Diagnostics in the current quarter.

Technocraft Industries (Market Cap – US$ 700mn)

Technocraft is a precision engineering company founded by first-generation technocrats. The company has four business divisions – 1) Drum Closures, 2) Scaffolding systems and Formwork, 3) Textiles and 4) Engineering Services. The company has compounded profits by 15% over the last 15 years.

Drum Closures: It is a niche segment with the global market estimated to be US$180-200m. This segment services industries such as oil and gas, food, and chemicals. Technocraft has a 36% market share and is the second-largest manufacturer globally. Almost 90% of its segment revenue derived from exports. It is a cash cow business which will grow at 2-3% annually, impressive 65-70% pre-tax ROIC.

Scaffolding & Formwork: This division will be the key growth driver for the company. Scaffolding is used for construction mainly in industry and real estate. Scaffolding is a complex business, requires quality certification and a large number of SKU’s. Almost 58% of this business is exports, mainly to the US market. In the formwork business, the company makes molds for construction of bridges and pillars. This business mainly caters to the infrastructure sector in the domestic markets. Technocraft is investing Rs 3.5bn and expects a 25% growth over the next 3-5 years for this division. Despite being working capital heavy, the business has a pre-tax ROIC of 20-25%.

Engineering services: This division employs 450 engineers globally. Initially this division was started for design of scaffolding in-house. Later it was expanded to other areas for external clients. It caters to multiple industry verticals, like heavy machinery, automotive, aerospace, etc. This segment can grow revenues by 30-40% for the next 3-5 years.

Textiles: The company’s fabric and yarn division has struggled to yield significant profits despite an investment of approximately Rs 4bn over the past 15 years. This has been a wrong capital allocation, which is now acknowledged by the management. They may be looking to exit this business.

Overall, the company can grow revenues and profits at 15% and 20% for next five years. Ex-textiles the company makes an ROIC of 25% plus. If the textile division is sold, cash could be returned to shareholders in the form of buybacks as demonstrated in the past.

Krsnaa Diagnostics (Market Cap US$ 275mn)

Krsnaa Diagnostics operates diagnostics and radiology centres on a public private partnership basis. The company is the largest radiology player in the country operating 134 MRI and CT Scan machines. Tenders are floated by state or central government under National Health Mission (NHM). The tenders are bid on cost of providing the service (which is usually around the Central Government Health Scheme (CGHS) rates) and the contract is awarded for a period of 5 to 10 years. Government expenditure on diagnostics is expected to increase from Rs 20bn in FY22 to Rs 80-100bn by FY30. Given the inadequate healthcare infrastructure and reasonable rates in government hospital footfalls are guaranteed.

Executing at scale is the unique skill required to grow in this business. Krsnaa has demonstrated ability to scale. It has 240+ doctors in Pune and through technology intervention it gets the scan images to Pune, where the doctors tele report the scans conducted over its centres. Scale also gives it unique capability to negotiate the consumable prices much better.

It requires Capex of Rs 60mn for MRI, Rs 15mn for CT scan and Rs 0.9mn for path labs. The company has also got a training centre to train the technicians. Working capital cycle is 40-50 days.

To conclude, the markets in certain pockets seem to have run ahead of the realities. Overall, we remain cautiously optimistic and continue to focus on identifying companies that can truly help in compounding over long-term.

Wishing you and your family a very Happy New Year!