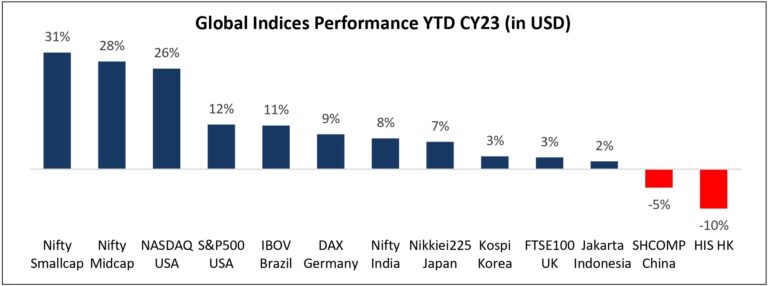

There are three things that stand out with respect to the recent performance of the Indian markets.

Small/Mid-caps have been massive outperformers YTD.

Source: Bloomberg

Cyclical sectors have been strong outperformers YTD.

Source: Bloomberg

Given the strong performance of Small/Mid cap companies, there is no doubt about exuberance in some parts of the market.

This exuberance can only be justified if the companies continue to scale up. As an investor, the question I would ask is, “How many of these small cap companies will really scale?”

I am reminded of a famous quote of Peter Lynch – “I don’t think people understand that there is a 100% correlation between what happens to a company’s earnings over several years and company’s stock.”

In this quarterly we go back in history (Since FY05) to look at the performance of the smaller companies then and how they have performed over the last 18 years. The conclusion is not surprising, only a small percentage of companies could scale and deliver reasonable returns.

Lessons from the past to guide us to the future.

There were approximately 1870 listed companies out of which 1780 had profits/losses of less than or equal to Rs1bn. Rather than looking at market cap, we took this cohort of <=Rs1bn to determine how many companies scaled to at least Rs1bn profits in FY23 and delivered a reasonable >= 15% p.a. compounding over this period.

Only 10% of companies compounded market cap at 15% and only 4% at 25% from FY05-FY23.

Source: ELC, ACE

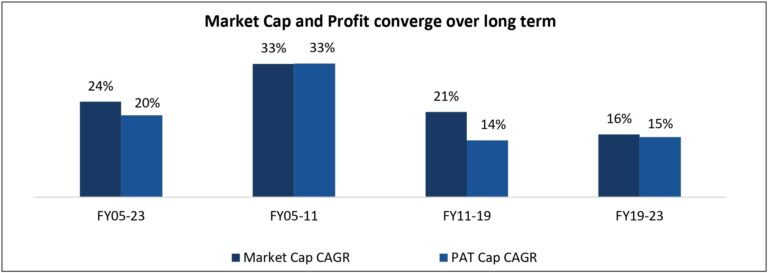

Market Cap CAGR and profits have converged over the long term.

Earnings are key driver of performance over the long-term. However, there can be lead and lag between profits and stock price in the short term.

Source: ELC, ACE

You will not be surprised to see the list of Individual stocks that have scaled from 2005.

India being an emerging market has opportunities across sectors. The companies which emerged as compounding machines had quality managements – good capital allocation, strong cashflow, strong balance sheet and excellent execution.

Source: ELC, ACE

Given the strong market performance, how much is already captured in the price?

It is not only important to identify the companies that have potential to scale, but also equally important to buy them at reasonable valuations. The starting valuations in FY05 @10x, current valuations though not at peak are towards the higher end of the trading range for the market.

Source: MOSL

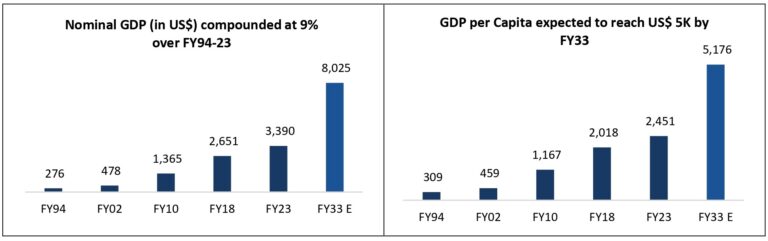

The long-term opportunity in India is attractive.

India’s nominal GDP is growing at a compounded growth of 9% in USD terms, i.e., the GDP doubles every eight years. If this historic trajectory is sustained, India’s GDP will reach US$8tr and a per capita GDP of US$ 5170 by FY33. As India approaches US$5000 per capita income lot of new opportunities will emerge.

Source: ELC, RBI

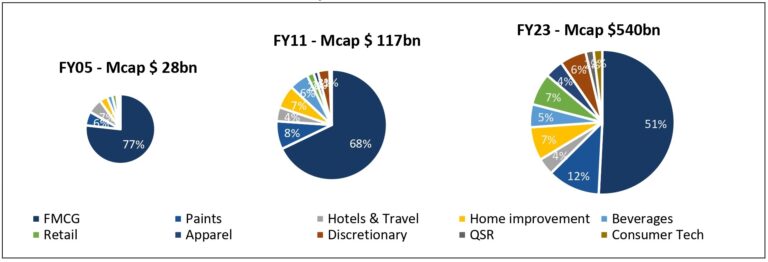

Evolution of consumer sector over the years.

Source: ELC, ACE

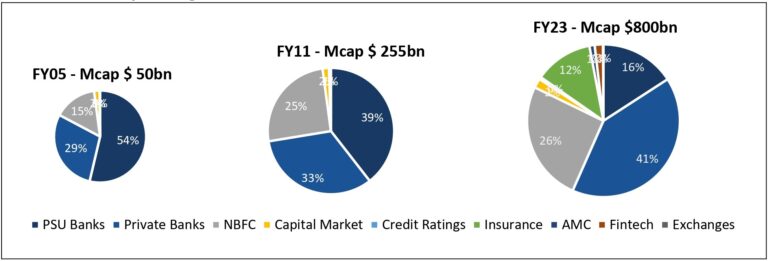

BFSI sector is expanding.

Source: ELC, ACE

In the long-term fundamentals is what matters

We are aware that it is not GDP growth but the individual company earnings over years which will drive stock performance. Competitive intensity, management’s ability, returns and cash flow are most important. Our focus at East Lane Capital is on the longer-term fundamentals. India being an emerging market offers numerous growth opportunities, our endeavor is to identify the right management which can scale businesses over long-term and buy them at reasonable price.

Let me now take the opportunity to discuss a stock that we added recently to our portfolio.

Aditya Vision – Market Cap – INR28bn

Aditya Vision is an electronics retail chain started in Bihar. It has a dominant market share with a network of 90 stores. Bihar is a laggard state with lower incomes but rising aspirations.

Apart from Bihar, Aditya Vision has similar socio-economic states like Jharkhand and Eastern U.P with about 15+ stores each. In the upcoming 5-7 years, the company has the potential to open 250 to 300 stores. Customer centricity, high inventory turns and a focus on costs have been the key driver of success so far. In FY24, it is expected to have a revenue of Rs 20bn and profits of Rs 850-900mn.

Source: ELC

Source: ELC