In our last quarterly, we shared our thoughts on the equity market performance for 2022 and our assessment of the equity markets for the future. If you would recall, India outperformed the global markets significantly in 2022. On the other hand, NASDAQ USA led the global market declines with the tech sector, in particular, being impacted the most with an unprecedented rise in interest rates in USA.

The first quarter of FY2023 has seen the NASDAQ USA bounce back smartly (up +17%), while Nifty-India underperforming several of its global peers (Down -3%). This quarter we look at some of the key factors impacting global and domestic markets and also share our views on the pharma sector which has underperformed over the last 12 months.

Global markets to remain volatile

Inflation and interest rates continue to remain key focus of the global markets. There has been a reduction in expectation of global growth due to rising rates. Unintended consequences of the current interest rate cycle, like the recent failure of SVS bank in US is keeping markets nervous.

We can think of three potential scenarios going forward:

1) Inflation and interest rates remain higher than expected, resulting in financial repression. Slow de-rating for the equities in this scenario.

2) High interest rates result in a worse than expected recession.

3) A mild recession, a soft landing, the best possible outcome.

Recent market action seems to be suggesting a scenario of soft landing, reflected in rebound in technology stocks in US last quarter. However, it is too early to call the outcomes. Global markets will continue to remain volatile.

Slowing consumption but macro looks reasonable

In India the macro balance sheet is in a reasonable shape. Inflation and rate cycle are plateauing for now. However, consumption, especially at the lower end of the markets is suffering and consequently growth expectations have been coming down. India will not be immune to global turmoil but better off on a relative basis. As a rule of thumb, 100bps reduction in global growth impacts India’s GDP by 40bps.

Govt capex key driver for growth

Indian markets have underperformed the global peers over the last 12 months. Slowing consumption and high valuations seem to have driven this underperformance. The government has been focused on reviving growth through increased expenditure on infrastructure and capex related stocks have been the bright spot over the last twelve months.

Valuations have corrected from the peak

With the market correction, valuations have trended towards longer term median. However, there are some risks in the near-term to earnings forecasts.

Closer look at the Pharma sector

While we keep the macro framework in mind, our focus remains on identifying the right stock for longer-term compounding. This quarter we look at the pharmaceutical sector, its emerging dynamics, risks and opportunities.

We have seen a sharp de-rating of pharmaceutical stocks over the last 12 months. The main culprit has been increased price competition in the US markets as well as US FDA actions against several companies in India. Over the long term, the market cap and profits go hand in hand.

US big opportunity or a profit sink?

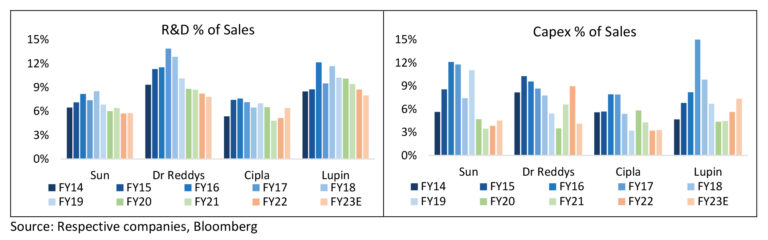

US is the largest pharma market in the world and consequently has attracted largest capital allocation and R&D investments. Especially the period of FY17-19 saw a huge surge in investments towards the US markets.

US FDA plant audits, a key risk

To sell in the US market, plants are audited and approved by the US FDA. FDA conducts audits at regular intervals. In recent years, there have been a number of adverse outcomes from these audits. The implications are that investments made in capex and R&D result in suboptimal returns. This is reflected in a dismal contribution of profits from US markets.

Scale increases cyclicality

US generics continue to see price competition, growth becomes a challenge as scale grows. It has been noticed that once a company reaches US$1bn revenue, cyclicality increases.

Go up the complexity curve and/or focus on branded generics

Indian domestic market and rest of the world branded generic markets can deliver steady growth. In the US, more complex products and branded specialty products will be needed to drive sustainable growth. Cyclical nature for commodity generics means downturns will be followed by upturns. A good mix of business, the right pipeline for US and attractive valuations will be essential to pick the right stocks in this sector.

Sold our position in Cipla and Laurus Labs

We sold out of our position in Cipla and Laurus Labs.

While Cipla has a very strong domestic business and strong complex product pipeline for the US market, recent US FDA observations on one of its key manufacturing facility at Indore made us nervous about time line for approval for future pipeline. It also increases the risk for one of the key Inhalation products being withdrawn from the market.

Laurus Labs is building scale and manufacturing excellence to supply active ingredients and formulations to global innovators and generic players. The existing product basket is facing a cyclical downturn and the pipeline of products for supplying to innovators will take some time to fructify. Valuations did not capture the mid-term risks.

In conclusion, we do expect volatility in the global markets to continue. India may get impacted to some extent in the short run but the long-term opportunity remains intact. At East Lane, our endeavour is to stay away from the short-term noise and remain focused on identifying businesses that can help us compound our wealth for our investors over the long term.